Shopify makes getting paid simple and efficient. Here’s how it works:

- Shopify Payments handles all transactions, depositing funds directly into your Shopify Balance account or your linked bank account.

- Payout Timing: Funds appear in Shopify Balance by 10 AM ET daily. Transfers to your bank take 2–5 business days depending on your region and bank.

- Fees: For online sales, Shopify Payments charges 2.4%–2.9% + $0.30 per transaction, based on your plan. In-person sales have lower fees.

- Accepted Payment Methods: Major credit/debit cards, Apple Pay, Google Pay, Shop Pay, and more.

- Setup: Activate Shopify Payments in your admin, link a compatible checking account, and enable two-step authentication for secure payouts.

- Shopify Balance: Offers faster access to funds and real-time spending options.

By using Shopify Payments, you avoid extra transaction fees from third-party gateways. You also gain access to tools for tracking payouts, managing cash flow, and resolving payment issues.

| Plan | Online Fee | In-Person Fee |

|---|---|---|

| Basic | 2.9% + $0.30 | 2.7% |

| Shopify | 2.6% + $0.30 | 2.5% |

| Advanced/Plus | 2.4% + $0.30 | 2.4% |

Key Tip: Monitor your payouts in the Shopify dashboard, and use Shopify Balance for quicker access to your revenue.

Getting paid with Shopify Payments || Shopify Help Center

How Shopify Payments Work

Shopify Payments is both a payment gateway and a payment processor, handling every step of a transaction – authorization, capture, clearing, and funding – all in one system. This seamless integration means you don’t have to juggle multiple platforms or worry about compatibility issues. It simplifies your setup, saving you time and effort.

Here’s how it works: when a customer enters their payment details at checkout, Shopify Payments securely processes the transaction using advanced encryption and fraud detection tools. The funds are then transferred to your Shopify Balance account. From there, you can either schedule transfers to your bank account or keep the funds in Shopify Balance for faster access. Plus, Shopify Payments makes fee management simpler compared to using external gateways.

Shopify Payments vs. Third-Party Gateways

Choosing Shopify Payments means skipping the complications of setting up a third-party payment provider. With external providers, you’re often stuck paying two sets of fees: Shopify’s transaction fees and the credit card processing fees from the third-party system. Shopify Payments eliminates this by waiving Shopify’s transaction fees for payments processed through its system, including Shop Pay, Shop Pay Installments, and PayPal Express. You only pay the credit card processing fee, which depends on your Shopify plan.

Another perk? Your payment data automatically syncs with your order management system, giving you a complete overview of your business from one central dashboard. Shopify Payments also enables major payment methods from the moment you set up your store, so there’s no need to apply for separate merchant accounts or deal with complicated API integrations.

Accepted Payment Methods

Shopify Payments supports a wide range of payment options to suit your customers’ preferences. You can accept all major credit and debit cards, including Visa, Mastercard, American Express, and Discover. It also supports accelerated checkout options like Apple Pay, Google Pay, and Shop Pay, which make the checkout process faster for returning customers.

Shop Pay stands out because it lets customers save their shipping and payment details securely, speeding up future purchases. It also offers order tracking, delivery updates, and carbon-neutral shipping options, features that can improve customer satisfaction and encourage repeat business.

Here’s a quick look at how different payment methods work with Shopify Payments:

| Payment Method | Provider Type | How Customer Pays | How You Get Paid |

|---|---|---|---|

| Shopify Payments | Payment gateway | Credit/debit cards | Shopify Payments |

| Apple Pay | Accelerated checkout | Using Apple Pay | Shopify Payments |

| Google Pay | Accelerated checkout | Using Google Pay | Shopify Payments |

| Shop Pay | Accelerated checkout | Using Shop Pay | Shopify Payments |

| Amazon Pay | Accelerated checkout | Using Amazon Pay | Shopify Payments |

Once you’re set up to accept payments, let’s break down the costs of using Shopify Payments.

Transaction Fees and Costs

Shopify Payments uses a tiered pricing structure that depends on your subscription plan. The fees are straightforward, with no hidden charges or monthly costs. For U.S. merchants, here’s the breakdown:

| Shopify Plan | Online Processing Fee |

|---|---|

| Basic | 2.9% + $0.30 |

| Shopify | 2.6% + $0.30 |

| Advanced | 2.4% + $0.30 |

| Plus | 2.4% + $0.30 |

The biggest advantage? These are the only fees you’ll pay when using Shopify Payments. Unlike external payment processors, Shopify won’t charge additional transaction fees, which can lead to considerable savings – especially for stores with high sales volumes.

Setting Up Payouts in Shopify

Getting your Shopify earnings starts with setting up your payout preferences. This involves linking a compatible bank account, enabling security measures, and selecting how you’d like to receive your funds.

Bank Account Requirements

To receive payouts through Shopify Payments, you’ll need to link a bank account that meets Shopify’s criteria. Keep in mind that not all bank accounts are compatible, so it’s crucial to verify yours beforehand.

For U.S.-based merchants, the requirements are specific: the account must be a full checking account with a U.S. bank, denominated in USD, and capable of handling Automated Clearing House (ACH) transfers. Accounts like savings accounts, flex-currency accounts, or those used exclusively for wire transfers won’t work. While non-Shopify virtual accounts are technically an option, they often face higher chances of payout failures.

Shopify uses Plaid to securely verify your bank account. To connect your account, go to Settings > Payments in your Shopify admin. Under the Shopify Payments section, click Activate Shopify Payments and follow the prompts to provide your business details. When you reach the "Add your banking information" step, choose "Connect a bank account via Plaid", sign in with your online banking credentials, select your account, and accept the terms. If you’ve already added your bank account manually, you can enhance processing by verifying it with Plaid. To do this, navigate to Settings > Payments > Manage > Change bank account.

Once your bank account is connected, secure your payouts with two-step authentication.

Two-Step Authentication for Security

To protect your earnings, Shopify requires two-step authentication for accounts receiving payouts through Shopify Payments. This extra layer of security means you’ll need a second verification method, such as an SMS code, an authenticator app, a security key, or a built-in authenticator, in addition to your email and password. Setting up a backup method is also a smart move in case your primary option becomes unavailable.

Store owners can enforce two-step authentication for all users by going to Settings > Users, selecting Security, and enabling this requirement for everyone. Keep in mind, the process may take some time depending on how many users your store has. Individual users can also set up two-step authentication by clicking their store name in the top-right corner of the admin, selecting Manage account, and navigating to the Security tab.

If you’d prefer faster access to your funds, you might consider Shopify Balance.

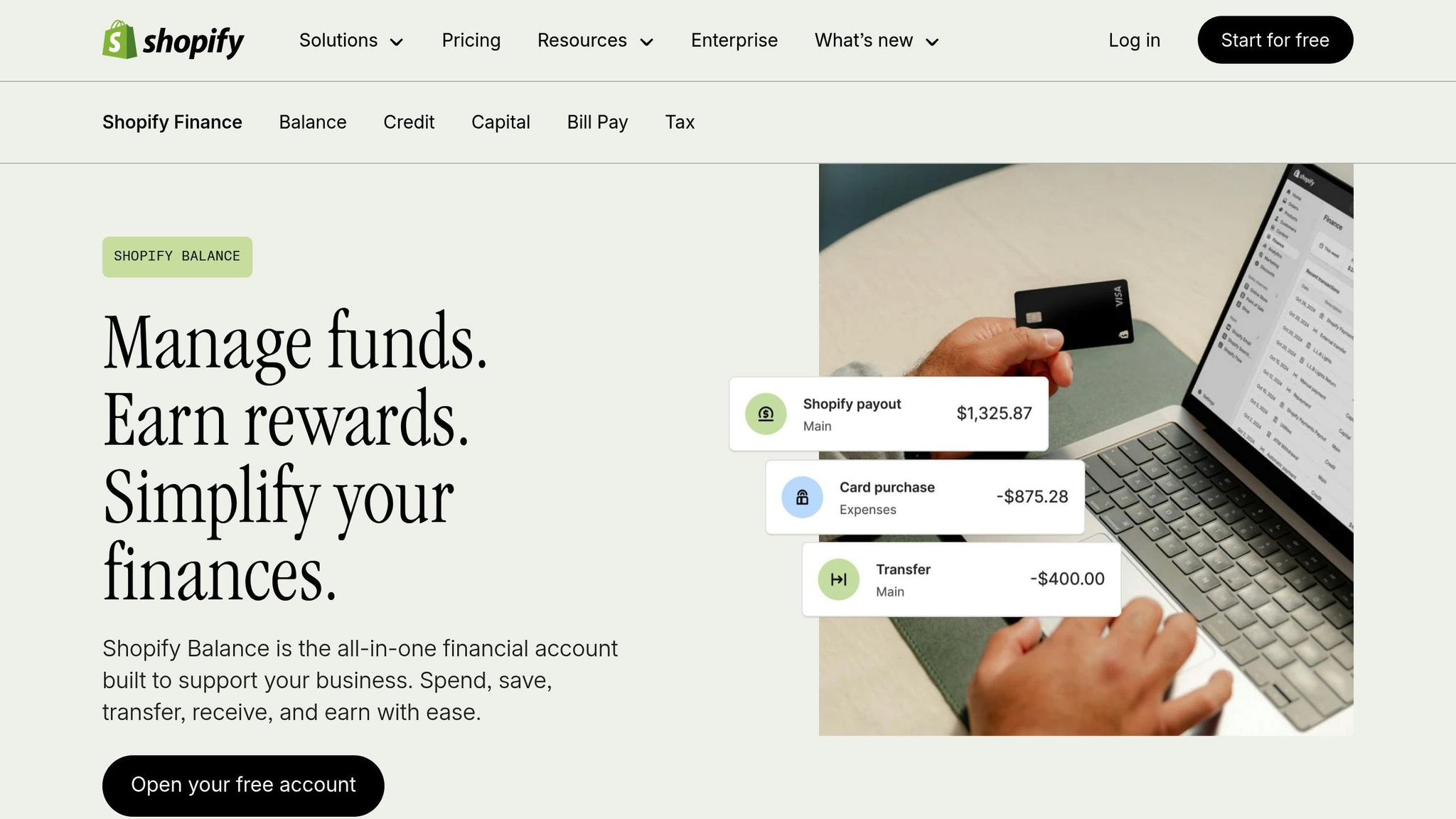

Shopify Balance

Shopify Balance offers an alternative to traditional bank accounts by holding your funds in a Shopify-managed account. Instead of transferring payouts to an external account, you can designate Shopify Balance as your primary payout method during setup. This option can be particularly useful if you’d like to manage your revenue within Shopify before transferring it elsewhere.

Whether you choose to connect a bank account or use Shopify Balance, setting up your payout preferences ensures you receive your earnings smoothly and securely.

Payout Schedules and Tracking

Once you’ve set up payouts, it’s important to understand when and how your funds will arrive. Shopify offers flexible scheduling options and tools to help you stay on top of your earnings.

Payout Schedules and Timing

Shopify allows you to choose how often you receive your funds, offering daily, weekly, or monthly payout schedules. By default, payouts are sent daily, but you can adjust this to fit your preferences. Funds are transferred to your bank account based on the schedule you select.

For merchants in the U.S., payouts are typically deposited within 2 to 5 business days after processing. However, the actual timing can vary depending on your bank’s processing speed. If you’re new to Shopify, your first payout may take longer, usually between 7 and 14 business days.

Shopify processes payouts using a 12:00 AM UTC (midnight) cutoff time. Sales made after this cutoff are included in the next payout cycle. Keep in mind that weekends and federal holidays can cause delays.

Other factors, including bank processing times, holidays, or failed payments, can also affect when you receive your funds. If your payout amount doesn’t meet the minimum threshold, it will remain pending until the threshold is reached during your next scheduled payout.

| Country | Currency | Payout Schedule | Minimum Payout Threshold |

|---|---|---|---|

| United States | USD ($) | 2 to 5 business days | None |

| Canada | CAD ($) or USD ($) | 3 business days | None |

| Australia | AUD, NZD, USD | 2 business days | None |

| United Kingdom | GBP (£) | 3 business days | £1 GBP |

| Germany | EUR (€) | 3 business days | €1 EUR |

| France | EUR (€) | 3 calendar days | €10 EUR |

Next, let’s look at how to track these payouts using your Shopify dashboard.

Tracking Payouts in Your Dashboard

Shopify’s admin includes a dedicated Payouts page, where you can keep track of all your payment activity. This page displays your past payouts, upcoming scheduled payments, and estimated dates for pending funds. You’ll also find a "To be paid" amount, which includes your scheduled payouts and any reserves being held.

Each payout is labeled with a status: Scheduled, Paid, or Failed. Clicking on a specific payout provides a detailed breakdown that includes the total amount, payout status, destination bank account, transfer reference number, and an itemized list of charges, refunds, adjustments, and reserves.

The Transactions section within each payout offers detailed information about individual sales included in that cycle. These transactions are also marked with statuses like Scheduled, Paid, Failed, or Pending (for sales not yet sent to your bank account).

If a payout shows as "Paid" but the funds haven’t arrived in your account, use the bank reference number from your dashboard to contact your bank. Having details like the settlement date, payout amount, and currency ready will help your bank locate the transfer.

Exporting Transaction Data

Shopify makes it easy to export transaction data for accounting or tax purposes. To do this, go to Analytics > Reports in your Shopify admin, select the report you need, and click Export. You can choose to export just the current view or the entire report. For transaction histories, navigate to your Orders page, click Export, and select "Export transaction histories".

These exports include fees and pending transactions, making it easier to reconcile your accounts. This data is particularly useful during tax season or when preparing financial records for accountants or lenders. You can also save reports as PDFs if you need physical copies.

For more advanced export options, third-party apps like Matrixify allow you to filter payouts by specific date ranges and export data in Excel or CSV formats with added customization.

With these tools, Shopify ensures you have everything you need to manage and monitor your revenue efficiently.

sbb-itb-6768865

Fixing Common Payment Problems

Even with smooth payment systems, occasional hiccups can disrupt fund transfers. Knowing how to spot and resolve these issues quickly can save you both time and stress, keeping your cash flow steady.

Failed Payouts

When a payout fails, Shopify notifies you via email and flags the issue on your admin dashboard, pausing future payouts until the problem is resolved.

The most common reasons for failed payouts include incorrect banking details, currency mismatches, unsupported account types, or a mismatch between the beneficiary name and the account holder. For instance, if you enter an incorrect routing or account number, the funds will bounce back to Shopify. Similarly, trying to receive USD in an account that only accepts EUR will result in a failed payout.

| Reason for Failed Payout | How to Resolve |

|---|---|

| Incorrect bank account details | Double-check and update your bank info. If issues persist, contact Shopify Support. |

| Currency mismatch | Use a bank account that supports the payout currency. |

| Unsupported account type | Switch to an account type that Shopify supports. |

| Mismatched account holder name | Ensure the account name matches what’s on file with your bank. Update details or contact Shopify Support if needed. |

| Insufficient funds for negative payouts | Shopify will deduct the amount from your next payout. |

To address a failed payout, start by reviewing the failure details in your Shopify admin notifications. Verify that your bank account details – such as account number, routing number, and account type – are accurate and match your bank’s records. Once corrected, use the "retry" option on the payout page. If this option isn’t available, Shopify will automatically retry the payout within three business days. Persistent issues should be escalated to Shopify Support.

Resolving failed payouts promptly is essential to maintaining smooth operations and avoiding interruptions in your cash flow.

Payment Delays

Delays in receiving payouts can be frustrating, especially when you’re relying on those funds for business needs. Several factors can cause delays, including account reviews, which Shopify may initiate to address chargeback disputes, compliance checks, fraud investigations, or high-risk orders.

Other causes of delays include custom payout schedules, reserves, weekends, public holidays, incomplete Shopify Payments setup, and bank processing times. Additionally, if your payout amount is below the minimum threshold in your region, the funds will remain pending until the next cycle when the threshold is met.

To troubleshoot delays, check your Shopify admin for alerts or notifications about your account. Look for emails from Shopify regarding payout issues. If your payout is marked as "Paid" but hasn’t reached your account, contact your bank’s ACH or Transfers department with the reference number provided in Shopify. Allow 1–3 business days for processing. Also, confirm that your bank account details and payout schedule are correct, and check Shopify’s status page for any system-wide issues. If problems persist, reach out to Shopify Support for further help.

Tax Reporting for U.S. Merchants

Shopify is required to report merchant earnings to the IRS via Form 1099-K for those meeting specific thresholds. For Tax Year 2023, merchants needed to process over $20,000 in gross payments and complete more than 200 transactions to receive a Form 1099-K. Starting in Tax Year 2024, the gross payment threshold drops to $5,000, regardless of transaction count. By 2026, the threshold will lower further to $600.

Shopify uses the tax information you provide during account setup to issue Form 1099-K. Missing or unverifiable tax details can lead to notifications prompting updates. Failing to update your tax information may result in paused payouts or account restrictions.

"As a merchant, you’re required to follow all applicable regulations, including tax reporting. Depending on your jurisdiction, Shopify Payments might also be required to report your sales to the local tax authorities. You’re responsible to consult with local tax authorities or a tax professional to verify the regulations that apply to you." – Shopify Help Center

Form 1099-K is typically delivered between January 31 and February 28 for the previous year’s transactions. The form reflects gross payments, so you’ll need to subtract business expenses like inventory, shipping, and fees to calculate your taxable income. To stay compliant, update your tax information (SSN or EIN) in your Shopify Payments account when prompted, cross-check the gross sales on your 1099-K with your records, and maintain detailed documentation of all sales and expenses. Even if you don’t receive a 1099-K, you’re still required to report all earnings to the IRS. Consulting a tax professional can help you understand deductions and tax responsibilities specific to your business.

Payment Tips for CPG Brands

Shopify’s streamlined payment processes provide a solid foundation for consumer packaged goods (CPG) brands to manage their cash flow more effectively. By strategically scheduling payouts and exploring funding options, these brands can navigate the unique challenges of inventory management, supplier payments, and fluctuating seasonal demand.

Matching Payouts with Business Needs

To ensure smooth cash flow, align your payout schedule with your business’s financial cycles. Shopify Payments allows brands to choose daily, weekly, or monthly payouts. The right choice depends on your sales patterns and operational needs. For instance:

- Daily payouts work well for brands with steady sales and immediate cash requirements, such as restocking inventory.

- Weekly payouts offer a middle ground, balancing cash flow with reduced administrative effort.

- Monthly payouts are ideal for businesses with robust cash reserves and longer planning horizons.

Take time to analyze past cash flow data and identify seasonal trends. Many CPG brands see sales surges during holidays, making it crucial to plan ahead. Additionally, review your receivables and payables, and negotiate better terms with suppliers to ease cash flow pressures.

"One critical aspect that demands attention is cash flow management (in fact according to a U.S. Bank study, 82% of businesses that failed cited cash flow problems as a factor in their failure)."

Effective cash flow management starts with accurate forecasting. Incorporate market trends, seasonality, and upcoming marketing campaigns into your projections to stay ahead of financial demands.

Once you’ve optimized your payout schedule, consider leveraging Shopify Capital for added funding flexibility.

Using Shopify Capital

Shopify Capital provides funding solutions tailored to help with inventory, marketing, and operational expenses. With funding amounts ranging from $200 to $2 million, the program offers flexibility by deducting repayments as a percentage of daily sales. This repayment model adjusts to your sales performance, ensuring cash flow stability even during seasonal fluctuations.

Jordan Lee of The Public Pet shared their experience:

"With Shopify Capital, our revenue increased by 40% to 50% – a direct result of expanding our inventory with new products."

To explore Shopify Capital, check your eligibility in the Finance section of your Shopify admin. Eligibility factors include your sales history, dispute rates, customer interactions, and compliance with Shopify’s Terms of Service. Unlike traditional business loans, Shopify Capital offers several advantages: no credit checks, no personal liability, and funding availability within as little as two business days.

Many CPG brands use Shopify Capital to strategically invest in high-performing products, scale successful marketing efforts, or secure bulk discounts from suppliers that require upfront payments. With the right approach, this funding can drive growth and improve financial stability.

Conclusion: Getting Paid with Shopify

Shopify’s payment system plays a critical role in maintaining smooth cash flow and supporting business growth. With options for daily, weekly, or monthly payouts, the platform offers flexibility to fit your needs. But it all starts with setting up your payout settings correctly.

Double-checking your bank account details is essential to avoid failed payouts or unnecessary delays. Make sure your bank information is accurate in your Shopify admin. Keep in mind that payouts won’t process on weekends or public holidays, and it typically takes 1–3 business days for funds to reach your account, depending on your payout schedule.

Stay proactive by monitoring your dashboard for any payment issues. Regularly exporting transaction data can help you reconcile earnings and fees more effectively. This is especially useful when matching payments to your bank statements using tools like QuickBooks or Xero. For added convenience, you can enable email notifications to keep track of each payout.

If you decide to change your payout schedule, note that pending funds might be delayed until the next cycle. For businesses that require faster access to funds, Shopify Balance provides instant transfers and real-time spending options. This feature can be a game-changer for managing immediate needs like restocking inventory or covering operational costs.

FAQs

How do I make sure my bank account works with Shopify Payments for smooth payouts?

To use Shopify Payments without any hiccups, your bank account needs to be a checking account that supports ACH transfers and can handle payouts in your selected currency. Stay away from accounts meant only for wire transfers or specialized service accounts, as they often won’t work with Shopify Payments.

It’s a good idea to contact your bank to verify these details and ensure smooth payout processing.

What should I do if my Shopify payout is delayed or fails to arrive?

If your Shopify payout seems delayed or hasn’t arrived, the first step is to check your payout schedule in your Shopify admin. Make sure the payment date has already passed. Next, confirm that your banking details are accurate and up-to-date – mistakes here can lead to delays.

If everything checks out, it’s a good idea to contact your bank. Sometimes, the issue might be on their end. Still not resolved? Reach out to Shopify Support. They can help dig into the issue and guide you on how to fix the delay.

What are the benefits of using Shopify Balance instead of a traditional bank account for payouts?

Using Shopify Balance for your payouts comes with some standout benefits compared to traditional bank accounts. For starters, you can get access to your funds much quicker – sometimes as soon as the next business day. In contrast, traditional banks often take several days to process payments, which can slow things down.

Another big plus? Shopify Balance helps you cut costs. Say goodbye to monthly maintenance fees and minimum balance requirements that many banks typically impose. It’s a smart, hassle-free way to manage your finances and keep more money in your pocket.